Cash Register vs POS vs MPOS vs EPOS vs Swipe Machine vs EFTPOS: Complete Guide

Summary

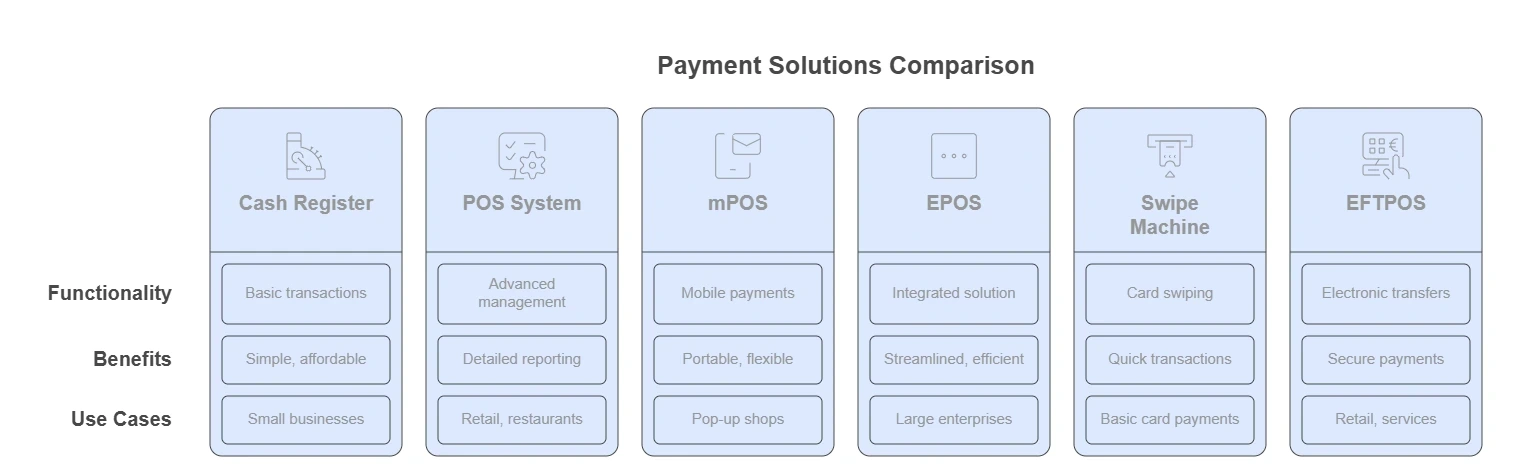

This guide explores the differences between cash registers, POS, MPOS, EPOS, swipe machines, and EFTPOS systems. We’ll look at how each system works, their pros and cons, and which businesses should use them. First we cover traditional cash registers, POS systems, and EFTPOS, then we examines EPOS, MPOS, swipe machines, comparison charts, and buying advice. Whether you run a small shop or a growing business, this article will help you choose the right payment system.

Traditional Systems & Basic Comparisons

Traditional Cash Registers: The Starting Point

Remember those old-school machines that went “cha-ching” when opened? Those are cash registers, the granddaddies of all retail payment systems. They’ve been around since the late 1800s, and though they’ve gotten fancier, their job remains simple – record sales and store cash safely.

A basic cash register does these things:

- Records sales amounts

- Stores money in a locked drawer

- Prints simple receipts

- Tracks daily totals

The problem? They don’t do much else. They’re like those old Nokia phones – they do the basics, but that’s about it.

“Cash registers are becoming dinosaurs in today’s digital economy,” says Rajesh Kumar, Retail Technology Specialist at Indian Retail Association. “They’re reliable but severely limited compared to modern options.”

In India, many small kirana stores and street vendors still use them. Why? They’re cheap, easy to use, and don’t need the internet. Plus, they work during power cuts – a big deal in some areas!

Mr. Patel, who runs a small grocery in Mumbai, tells me: “I’ve had my cash register for 15 years. No monthly fees, no technical problems. Just works.”

But here’s the truth – cash registers are like bicycles in the age of cars. They’ll get you there, but slowly and with lots of effort.

Point of Sale (POS) Systems: The Modern Standard

POS systems are the smart upgrade to cash registers. Think of cash registers as basic phones, while POS systems are smartphones.

A good restaurant POS system does way more than just take money. It’s the brain of your business, handling:

- Sales processing

- Inventory management

- Customer data collection

- Staff performance tracking

- Reports and analytics

- Loyalty programs

Ramesh Gupta from Tata Consultancy Services explains: “A modern POS system connects all parts of your business. It tells you what’s selling, what’s not, who’s buying, and how your staff is performing.”

The magic of POS is in its brain – the software. While cash registers are mostly hardware, POS systems combine hardware (touchscreens, barcode scanners, receipt printers) with powerful software.

According to 2023 data from Retail Technologies India, businesses that switched from cash registers to POS systems saw:

- 12% increase in average sale value

- 23% reduction in inventory errors

- 9% improvement in customer return rates

Radha’s Fashion Boutique in Delhi made the switch last year: “Before, I had no idea which styles were selling best. Now my POS tells me everything – which colors are hot, which sizes move fastest, even which staff sell the most.”

POS systems cost more upfront than cash registers, plus you may pay monthly software fees. But for most businesses, the extra sales and saved time make it worth it.

The secret no one tells you? The data your POS collects is often more valuable than the time it saves. Smart business owners use this data to make better decisions about everything from staffing to inventory.

Read this: How To Choose the Perfect POS for Your Restaurant in India

Hundreds of restaurants increased profits by 23% in their first month using our POS system. Limited spots available for our free personalized demo this month! Click now to secure yours before they’re gone.

Electronic Funds Transfer at Point of Sale (EFTPOS): Regional Payment Processing

EFTPOS is popular in Australia and New Zealand, but has versions worldwide. In India, we might not use this exact term, but we use similar systems.

EFTPOS specifically means the system that lets customers pay directly from their bank accounts using debit cards. It’s different from credit card processing, which goes through Visa/Mastercard networks.

“EFTPOS systems reduce cash handling by approximately 60% for businesses that implement them properly,” notes financial analyst Priya Sharma.

The big benefits of EFTPOS:

- Money goes straight to your bank account

- Lower fees than credit cards (usually)

- Faster processing than checks

- Less cash handling means fewer mistakes

In India, UPI has become our version of instant electronic transfers. Many shops now have QR codes that work with apps like Google Pay or PhonePe, creating a simple EFTPOS-like system.

A recent study by Payment Systems India found that businesses using electronic payment systems spent 7.5 fewer hours per week on accounting and had 4.3% fewer discrepancies in their books.

Small restaurant owner Vikram in Bangalore shares: “When we only took cash, we spent hours counting and recounting. Now with UPI and card payments, closing time is 30 minutes, not 2 hours.”

The controversial bit? Banks and payment processors don’t want you to know how much they make from these systems. The fees seem small (1-2%), but they add up to crores of rupees annually from small businesses.

Electronic Point of Sale (EPOS): Digital Evolution

EPOS systems are essentially digital POS systems – the terms often get used interchangeably, but there are differences.

All EPOS systems are POS systems, but not all POS systems are EPOS systems. Confused? Let me explain with a simple example.

A basic POS might use a simple computer program and connect to basic hardware. An EPOS is fully digital, often cloud-based, and integrates with many other digital systems.

“EPOS systems represent the digital transformation of retail,” explains tech consultant Amit Verma. “They bring enterprise-level capabilities to businesses of all sizes.”

Key features that make EPOS special:

- Cloud-based operation

- Real-time data access from anywhere

- Advanced inventory management

- Customer relationship tools

- Multi-location capabilities

- Integration with e-commerce

Many modern food ordering systems are built on EPOS technology. They let restaurants manage in-house dining, takeaway, and delivery all from one system.

The stats are impressive. According to Retail Technology Today, businesses using EPOS systems:

- Process transactions 35% faster than traditional POS

- Experience 27% fewer system downtimes

- Can launch marketing campaigns 68% faster

Deepak’s Electronics Chain switched to EPOS last year: “Now I can see sales across all five stores in real-time. If something’s selling well in one location, I can quickly move inventory from another store.”

EPOS systems typically cost more – expect to pay Rs.25,000-Rs.100,000 for hardware plus monthly software fees (₹2,000-₹10,000 depending on features). But for growing businesses, the investment often pays off quickly.

Here’s a secret most vendors won’t tell you: Many EPOS providers make their real money not from the system itself, but from payment processing fees. Always negotiate these fees – they’re often more flexible than the sticker price of the system itself.

Mobile Point of Sale (MPOS): Flexibility and Mobility

MPOS systems are exactly what they sound like – mobile POS solutions. They turn tablets, smartphones or specialized handheld devices into powerful point-of-sale systems.

The best thing about MPOS? You can take payments anywhere – at tables in a restaurant, in the aisles of a store, at a festival stall, or even at customers’ homes.

“MPOS technology has revolutionized how small businesses operate,” says mobile payment expert Sanjay Kapoor. “It’s democratized access to sophisticated payment tools.”

The main components of MPOS:

- A mobile device (tablet or smartphone)

- A payment card reader (that plugs into the device)

- MPOS software or app

- Optional portable receipt printer

Many modern QR code ordering systems use MPOS technology. Customers scan, order, and pay through their phones, while staff receive orders on mobile devices.

Fitness trainer Lakshmi started using MPOS for her home training sessions: “Before, clients would forget cash or I’d have to send payment links later. Now I just swipe their card after the session. My late payments dropped by 80%!”

Research from Mobile Payment Quarterly shows MPOS adoption in India grew 68% between 2021-2024, with the fastest growth among service providers and small retailers.

The costs are much lower than traditional systems. Many MPOS providers charge just:

- Rs.2,000-Rs.5,000 for the card reader

- 2-3% per transaction

- Small or no monthly fee

Here’s something vendors won’t advertise: Many MPOS systems work poorly in areas with spotty internet. Always check if the system can process offline transactions that sync later when connection returns.

Comparison: Cash Register vs POS

Let’s get practical and compare these systems head-to-head:

| Feature | Cash Register | POS System |

|---|---|---|

| Cost | Rs.10,000-Rs.30,000 one-time | Rs.30,000-Rs.100,000 + monthly fees |

| Inventory Tracking | Manual or basic | Automated and detailed |

| Reports | End-of-day totals | Comprehensive analytics |

| Customer Data | None | Detailed histories and preferences |

| Staff Management | Basic | Time tracking, performance metrics |

| Integration | Limited or none | Accounting, e-commerce, etc. |

| Training Time | 1-2 hours | 1-2 days |

| Lifespan | 10+ years | 3-5 years |

“The right choice isn’t always the most advanced system,” notes retail consultant Neha Sharma. “It’s the system that fits your business needs and growth plans.”

For very small operations (like a paan shop), a cash register might be enough. For almost everyone else, basic POS is the minimum standard today.

The real costs often aren’t visible upfront. Cash registers have almost no ongoing costs, while POS systems have software subscriptions, support fees, and upgrade costs.

Vegetable vendor Raju shares: “I tried a fancy POS but went back to my cash register. Too complicated and expensive for my small business.”

Meanwhile, boutique owner Aisha counters: “My POS paid for itself in six months just from the inventory shrinkage it prevented.”

Advanced Systems & Making the Right Choice

Swipe Machines/Card Terminals: Focused Payment Processing

Swipe machines (or card terminals) do one job – process card payments. These are the machines you see at checkout counters where you insert, swipe, or tap your card.

Unlike full POS systems, swipe machines focus only on accepting payments. They’re simple and reliable, but limited.

“For many small businesses, a standalone card terminal paired with a traditional method of recording sales is still the most cost-effective solution,” says banking expert Harish Menon.

Modern card terminals come in several types:

- Countertop terminals (need power and internet connection)

- Wireless terminals (work within your WiFi range)

- Mobile terminals (use cellular data to work anywhere)

According to Payment Processing India, businesses that add card acceptance see an average 22% increase in transaction value compared to cash-only operations.

Small hardware store owner Ganesh tells his story: “I resisted card payments for years. When I finally got a swipe machine, my sales jumped Rs.2,000 per day almost immediately.”

Most terminals cost Rs.5,000-Rs.15,000 to buy or Rs.500-Rs.1,000 monthly to rent, plus transaction fees of 1.5-3% depending on the card type.

The secret banks don’t advertise? Different cards have different processing fees. Premium credit cards might cost you 3% per transaction, while basic debit cards might be under 1%. But your terminal provider might charge you a flat rate that’s higher than necessary.

POS vs MPOS: When Mobility Matters

Let’s compare traditional POS with mobile POS systems:

| Feature | Traditional POS | MPOS |

|---|---|---|

| Mobility | Fixed location | Go anywhere |

| Hardware Cost | Rs.30,000-Rs.100,000 | Rs.5,000-Rs.20,000 |

| Transaction Speed | Very fast | Depends on connection |

| Durability | High | Medium |

| Battery Concerns | None (plugged in) | Needs regular charging |

| Screen Size | Larger, easier to use | Smaller, more compact |

| Offline Capability | Often better | Limited in many systems |

“MPOS isn’t just about being mobile,” explains tech analyst Vihaan Mehta. “It’s about transforming the customer experience by bringing checkout to them, rather than forcing them to go to a counter.”

For restaurants, MPOS means servers can take orders and payments at tables. For retail, staff can help customers and check them out right in the aisles. For service businesses, it means accepting payments anywhere you meet clients.

A 2023 survey by Retail Technology Today found that retail stores using MPOS saw:

- 24% reduction in perceived wait times

- 18% increase in add-on purchases

- 15% improvement in customer satisfaction scores

Fashion retailer Leela shares: “During busy sale days, we add three MPOS devices to complement our regular counters. Checkout lines disappear, and we sell more because customers don’t get frustrated waiting.”

The biggest drawback of MPOS? Battery life and internet dependence. Always have backup options for when either fails.

EFTPOS vs POS: Understanding the Relationship

Many people get confused about EFTPOS vs POS. Here’s the simple explanation: EFTPOS is a type of payment processing that can be part of a POS system.

POS is the complete system for managing sales, while EFTPOS is specifically about processing electronic payments from bank accounts.

In India, we might use:

- POS system for the complete sales management solution

- Payment terminal or swipe machine for the device that accepts cards

“The terminology varies by country,” notes payments expert Rohan Desai. “What matters is understanding the functions you need, not the labels used.”

In Australia or New Zealand, you might hear “EFTPOS machine,” while in India, we usually say “card machine” or “swipe machine” for the same device.

Recent data from Banking Technology Weekly shows that 72% of Indian urban consumers now prefer electronic payments over cash, up from 41% in 2019.

Small business owner Meena explains: “I didn’t understand all these terms at first. What mattered was getting a system that let customers pay how they want, while giving me the sales information I need.”

The important thing is that your payment processing (whatever you call it) integrates well with your sales management system. Otherwise, you’ll spend hours reconciling numbers.

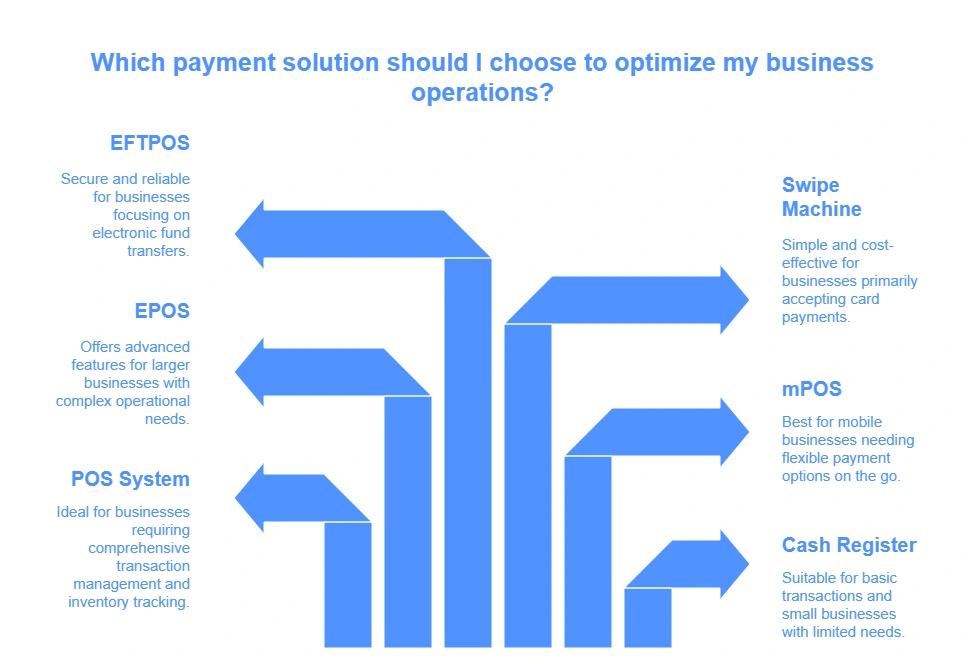

Choosing the Right System: Decision Matrix

With all these options, how do you choose? Consider these factors:

- Business Size

- Micro (1 person): Cash register or MPOS

- Small (2-10 staff): Basic POS or EPOS

- Medium (11-50): Full EPOS system

- Large (50+): Enterprise EPOS

- Transaction Volume

- <20 daily: Cash register or MPOS might be enough

- 20-100 daily: Basic POS recommended

- 100+ daily: Full EPOS for efficiency

- Mobility Needs

- Fixed location only: Traditional POS

- Some mobility: Hybrid POS/MPOS

- Fully mobile business: MPOS

- Budget Constraints

- Very tight: Cash register + separate card terminal

- Limited: Basic POS or MPOS

- Moderate: Full POS or EPOS

- Substantial: Enterprise EPOS

“The best system is one that solves your current problems while allowing room for growth,” advises business consultant Arjun Nair. “Don’t buy features you’ll never use, but don’t limit your future potential either.”

Integration Capabilities: Making Systems Work Together

Modern businesses need their systems to talk to each other. Here’s what to consider:

The best systems connect with:

- Inventory management

- Accounting software

- E-commerce platforms

- Customer relationship management (CRM)

- Employee scheduling and payroll

- Delivery management

According to Enterprise Technology Monthly, businesses with fully integrated systems spend 64% less time on administrative tasks and report 37% fewer data errors.

Restaurant owner Kabir shares: “Our POS connects to our food ordering system, accounting software, and delivery platforms. When a customer orders online, it automatically appears on our kitchen display system. No manual entry means no mistakes.”

When evaluating systems, always ask about API access – this is what allows different software to connect.

The hidden truth? Many providers charge extra for integrations or limit which third-party services you can connect to. Always check integration capabilities and costs before buying.

Total Cost of Ownership: Looking Beyond the Price Tag

The sticker price never tells the whole story. Consider these costs:

- Initial Investment

- Hardware costs

- Software licenses

- Installation fees

- Initial training

- Ongoing Expenses

- Monthly/annual software fees

- Payment processing fees

- Support contracts

- System updates

- Hidden Costs

- Staff training time

- System downtime

- Data migration

- Customization needs

Finance director Priyanka Roy notes: “Many businesses choose systems based on upfront cost, then get surprised by high monthly fees or expensive add-ons they didn’t anticipate.”

A comprehensive calculation from Retail Economics India suggests the 5-year cost of ownership breaks down as:

| System Type | Initial Cost | 5-Year Total Cost |

|---|---|---|

| Cash Register | Rs.15,000 | Rs.25,000 |

| Basic POS | Rs.50,000 | Rs.1,00,000 |

| EPOS | Rs.1,00,000 | Rs.2,50,000 |

| MPOS | Rs.10,000 | Rs.70,000 |

Pharmacy owner Rahul advises: “Ask for a complete breakdown of all costs over 3-5 years. Many salespeople only focus on monthly software costs but ignore transaction fees, which often cost more in the long run.”

Future Trends: Where Payment Systems Are Heading

Payment technology keeps evolving. Here’s what’s coming:

- Contactless Everything Not just cards, but watches, phones, and even biometric payments (fingerprint, face recognition) are becoming normal.

- Integrated Commerce Systems that seamlessly connect in-store, online, and mobile sales channels.

- AI-Powered Analytics Smarter systems that don’t just record sales but predict trends and recommend actions.

- Subscription-Based Models More providers switching to all-inclusive monthly fees rather than upfront costs.

- Cryptocurrency Acceptance More systems adding options for digital currency payments.

“The line between e-commerce and physical retail is disappearing,” observes tech futurist Ananya Mehta. “Tomorrow’s POS systems won’t just be about payments – they’ll be central nervous systems for all customer interactions.”

Conclusion: Making Your Decision

Choosing between cash registers, POS, MPOS, EPOS, and card terminals comes down to understanding your business needs:

- For simplicity and lowest cost: Cash register

- For basic sales tracking and card payments: Simple POS

- For mobile businesses or line-busting: MPOS

- For growing businesses needing detailed data: EPOS

- For minimal card processing without bells and whistles: Card terminal/swipe machine

Remember that the right system grows with your business. What works today might be too limited next year.

Retail consultant Vikash Tandon offers this final advice: “Choose a system that solves your biggest current pain point but can scale as you grow. The cheapest option often becomes the most expensive when you factor in lost opportunities and eventual replacement costs.”

Whatever system you choose, make sure you get proper training for yourself and your staff. Even the best technology is useless if people don’t know how to use it effectively.

The most successful businesses view their payment systems not as expenses, but as investments in efficiency, customer experience, and growth.